Realtime and Instant Payments are Transforming Treasury Management

2023 is the year realtime payments come into their own in the United States. Realtime payments, also known as instant payments, promise faster processing times and improved security compared to traditional methods. In addition to the continued growth of the RTP and Zelle services, the Federal Reserve is preparing to release its FedNow service in July.

With e-commerce accelerating, the ability to continually push purchases, sales, and deliveries calls for faster liquidity management. Realtime payments can enable a corporate treasury to maintain flexibility and immediate turnaround on the day-to-day needs of an enterprise.

It’s a significant change in liquidity management. Banks processed payments in blocks at designated times throughout a five-day workweek, which made predicting liquidity relatively easy. Increasingly, transactions can move 24/7, 365 days a year.

Businesses and consumers can both take advantage of immediate payments, either by avoiding late fees for bill payments or receiving good funds immediately. The new instant payment systems may take time to manage effectively, but adoption is expected to continue.

Trends in countries that have adopted faster-payment schemes show generally increasing consumer uptake. There is no reason to think that U.S. businesses and consumers would react differently.

While there’s still a lot of work to be done before financial institutions see cash and paper check transactions continue to fade away, realtime payments are here and ready to be leveraged to transform the way treasurers do business.

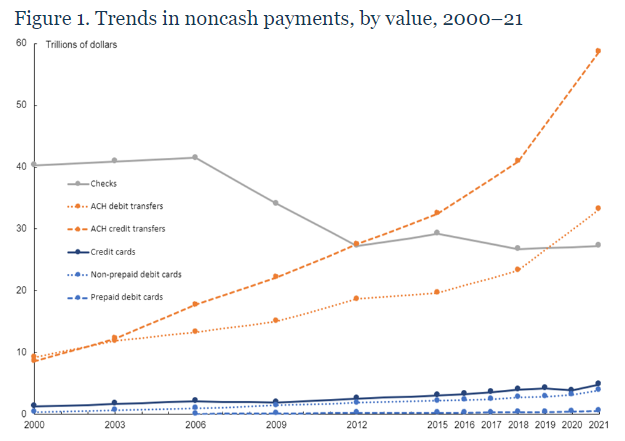

Noncash payments in the U.S. continue to grow, with the total value increasing at a rate of 9.5% per year from 2018 to 2021, according to the most recent survey data from the Federal Reserve. The survey also found that the total number of noncash payments increased at a 5.6% CAGR over the same period, primarily driven by increases in the value of card payments and ACH payments.

The Federal Reserve’s FedNow is expected to accelerate those trends. FedNow is a new instant payment service that will enable financial institutions of all sizes and communities across the United States to provide safe and efficient instant payment services 24/7, 365 days.

Businesses and individuals can send and receive instant payments conveniently through financial institutions participating in the FedNow Service, and recipients will have full access to funds immediately, giving them greater flexibility to manage their money and make time-sensitive payments. FedNow was designed to provide market choice for clearing and settling instant payments, in keeping with the Federal Reserve’s historical role of providing payment services alongside private-sector providers.

At Canright, we understand realtime and faster payments and can help provide guidance in the matter. Companies planning and offering realtime payments services to financial institutions and corporations will require training materials and product communication. We can help!

To learn more about our services, contact us at collin@canrightcommunications.com

Resources

Footer

Stay Connected

Who We Are

Canright Communications simplifies complex concepts—helping clients market and sell their ideas, innovations, products, and services.